Party Safety and Insurance: Protecting Against Unexpected Risks

Read MoreParty Safety and Insurance: Protecting Against Unexpected Risks

Read MoreParty Safety and Insurance: Protecting Against Unexpected Risks Read MoreParty Safety and Insurance: Protecting Against Unexpected Risks

Read MoreParty Safety and Insurance: Protecting Against Unexpected Risks Read MoreWhat are the Pros of Having Boat Insurance in New York?

Read MoreWhat are the Pros of Having Boat Insurance in New York? Read MoreHow Tariffs Impact the Housing Market: What You Need To Know

Read MoreHow Tariffs Impact the Housing Market: What You Need To Know Read MoreUnderstanding Stress and Anxiety: What You Need to Know!

Read MoreUnderstanding Stress and Anxiety: What You Need to Know! Read MoreThe Truth About Technology and What They Aren’t Telling You

Read MoreThe Truth About Technology and What They Aren’t Telling You Read MoreThriving in the Digital Age: Balancing Technology, Health, and Connections

Read MoreThriving in the Digital Age: Balancing Technology, Health, and Connections Read MoreBeyond the Game: Life After Sports & Hidden Risks

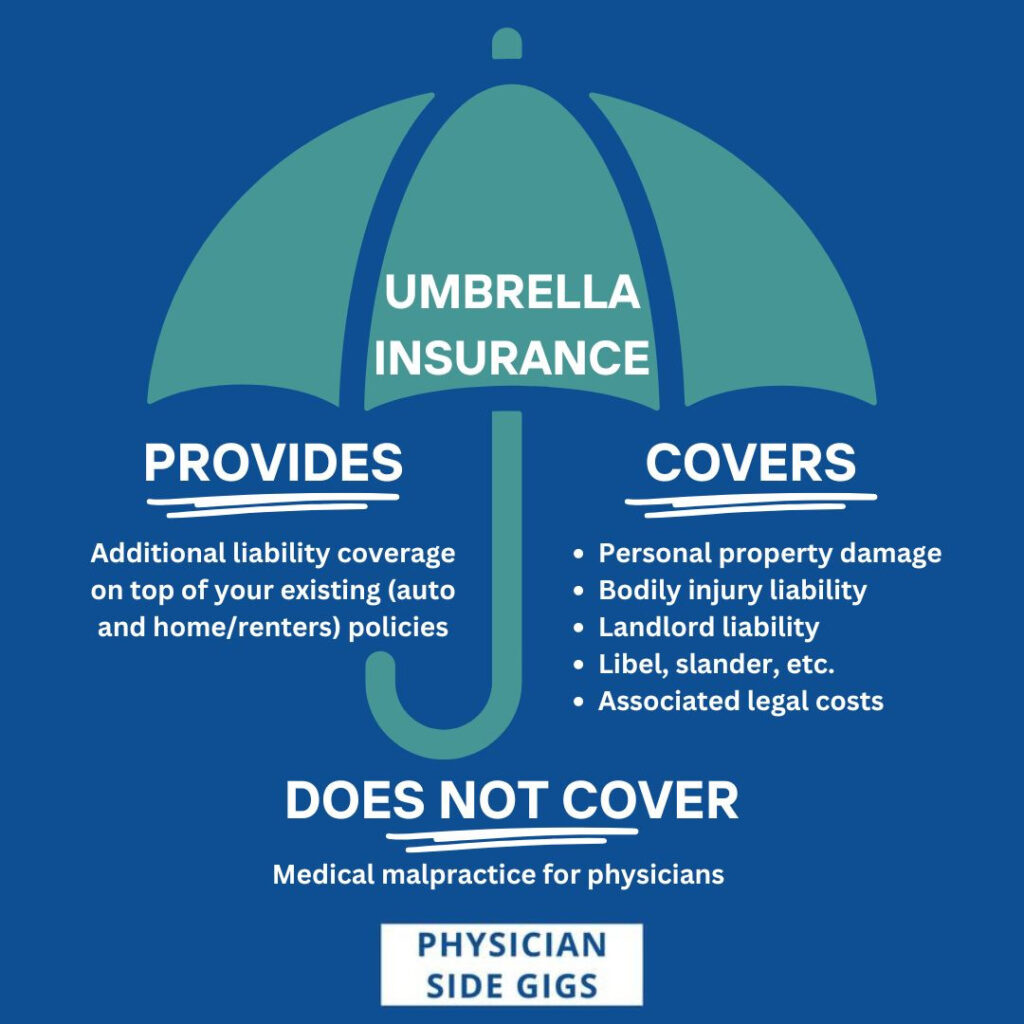

Read MoreBeyond the Game: Life After Sports & Hidden Risks Read MoreWhat is umbrella insurance and why you should have it?

Read MoreWhat is umbrella insurance and why you should have it?